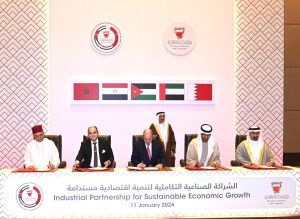

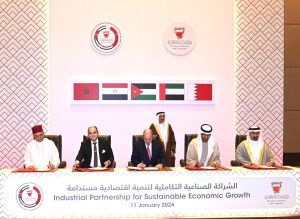

In the presence of His Excellency Shaikh Khalid bin Abdulla Al Khalifa, Deputy Prime Minister of the Kingdom of Bahrain, the fourth meeting of the Higher Committee of the Industrial Partnership for Sustainable Economic Development began today in Manama, Bahrain. During the proceedings, the Kingdom of Morocco became the fifth country to join the partnership aimed at strengthening regional industrial integration.

The meetings were held with the participation of His Excellency Abdullah bin Adel Fakhro, Bahrain’s Minister of Industry and Commerce, His Excellency Dr. Sultan bin Ahmed Al Jaber, the UAE’s Minister of Industry and Advanced Technology, His Excellency Engineer Ahmed Samir Saleh, Egypt’s Minister of Industry and Trade, His Excellency Yousef Al Shamali, Jordan’s Minister of Industry, Trade and Supply, and His Excellency Riyad Mazour, Morocco’s Minister of Industry and Trade.

The Executive Committee of the Industrial Partnership for Sustainable Economic Development held meetings with officials, including industry and trade undersecretaries from the partner countries, on 10 January 2024 to discuss the progress of current projects and new proposals.

The industrial partnership has received robust support from member countries since its launch in Abu Dhabi in May 2022. His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, praised the partnership’s role as a framework for cooperation and integration in the region, accelerating sustainable development, strengthening crisis resilience and increasing self-sufficiency in critical areas such as food, health, energy and industry among others. The launch ceremony was witnessed by His Highness Sheikh Mansour bin Zayed Al Nahyan, Vice President, Deputy Prime Minister and Minister of the Presidential Court, His Excellency Dr. Bisher Al-Khasawneh, Prime Minister of Jordan and His Excellency Dr. Moustafa Madbouly, Prime Minister of Egypt.

During the meeting, UAE’s W Motors, the strategic partner of NWTN Motors, and Jordan’s Manaseer Group signed an agreement to establish an electric car manufacturing plant in Jordan, with an investment value of $80 million.

Additionally, Manaseer Group and Bahrain’s Alba signed a memorandum of understanding (MoU) to supply 13,000 tons of aluminum fluoride annually, contributing to an import substitution value of $20 million. Bahrain’s Alba also signed an MoU with Jordan Phosphate Mines for silica supply, contributing to an import substitution value of $66 million.

Bahrain Steel signed a supply agreement with Emirates Steel, which will purchase 2 million tons of raw materials over five years, valued at $2 billion. A MoU was also signed between the UAE’s Ministry of Industry and Advanced Technology (MoIAT) and Bahrain’s Ministry of Industry and Commerce leveraging the UAE’s National In-Country Value (ICV) Program. The initiative is aimed at sharing best practices with respect to local content programs.

His Excellency Abdullah bin Adel Fakhro, Bahrain’s Minister of Industry and Commerce, stressed the Bahraini government’s commitment to the development of the industrial sector, embodied by the event being hosted in Manama under the patronage of His Royal Highness Prince Salman bin Hamad Al Khalifa, Crown Prince and Prime Minister of the Kingdom of Bahrain. He pointed to the event’s role in achieving industrial integration among the member countries in line with Bahrain’s Industrial Sector Strategy 2022-26.

His Excellency said: “The meeting saw the signing of a memorandum of cooperation under the National In-Country Program between the Ministry of Industry and Commerce and the UAE’s Ministry of Industry and Advanced Technology, a key industrial enabler for procurement competitiveness and import substitution in both countries.”

His Excellency welcomed the addition of Morocco to the partnership, which is a key industrial and economic player in the region.

In his opening remarks at the meeting, His Excellency Dr. Al Jaber relayed the greetings of His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, as well as his wishes for the partnership’s further success, especially in strengthening relations between countries to leverage competitive advantages.

He said: “We welcome the Kingdom of Morocco’s addition to the partnership, given its leading industrial and economic status, and achievements across various sectors – particularly industry – which is vital to supporting investment opportunities. In the UAE, we believe that forming strategic partnerships is a fundamental pillar of achieving national economic, social, and developmental objectives. This integrated industrial partnership, originating in Abu Dhabi in May 2022, is a model of successful regional partnerships.

“We are pleased to witness the announcement and signing of five new projects and export agreements in priority sectors, with a total value of approximately $2.2 billion, enhancing cooperation between the UAE’s Ministry of Industry and Advanced Technology and Bahrain’s Ministry of Industry and Commerce in line with the National ICV Program.”

He continued: “The new projects solidify our countries’ ability to integrate, build a common industrial base, support the flexibility of supply chains, reduce production costs, enhance research and development, and train a new generation in the industrial and technological fields. Additionally, they contribute to creating thousands of jobs in the industrial sector. We look forward to launching more innovative projects to achieve the partnership’s strategic goals.”

He noted: “The partnership has made significant progress in encouraging cooperation and boosting industrial partnership opportunities. We are confident that it will contribute to enhancing integration and growth in the industrial sector on the regional level, supporting efforts for sustainable economic development.”

His Excellency added: “Strengthening industrial cooperation and coordination efforts between our countries achieves several goals, including supporting sustainable economic development, creating more investment opportunities in the region, increasing the industrial sector’s contribution to our countries’ GDP, supporting import substitution, promoting self-sufficiency, and empowering future industries through advanced technologies, research and development.”

He concluded: “The UAE hosted COP28 in December, which achieved unprecedented success, embodied by the historic UAE Consensus, which signaled a new era in global climate action. The plan aims to keep 1.5°C within reach by reducing emissions while creating opportunities for sustainable economic and social growth. Here, I would like to emphasize the importance of our collective role in supporting this agreement by decarbonizing the industrial sector, adopting renewable energy solutions, promoting the adoption of clean technology solutions in our projects and leveraging significant opportunities in sustainable manufacturing.”

His Excellency Yousef Al Shamali, Jordan’s Minister of Industry, Trade and Supply welcomed each of the ministers and emphasized the partnership’s importance in accelerating sustainable economic development in the region.

His Excellency said: “The partnership is a regional model for enhancing sustainable economic growth and development through strategic planning. A key aspect of the partnership is leveraging raw materials in Arab countries, which represent 75% of their global exports, to build an industrial system that uplifts economies.”

His Excellency Engineer Ahmed Samir Saleh, Egypt’s Minister of Industry and Trade, welcomed Morocco to the partnership, stressing that Egypt is looking forward to the cooperation and to building upon the country’s competitive advantages, vision and investments.

He emphasized Egypt’s commitment to the projects launched under the partnership, which will benefit from each partner countries’ industrial capabilities and contribute to sustainable economic growth amid a turbulent global economy.

His Excellency Riyad Mazour, Morocco’s Minister of Industry and Trade, said: “Joining the industrial partnership is in line with the vision of King Mohammed VI of Morocco, to strengthen cooperation and achieve greater economic development. It will contribute to sustainable economic development; it also represents an opportunity for us to further integrate and develop projects that generate growth and employment opportunities for national talent.”

Morocco’s Membership

Morocco is expected to bring significant value to the partnership, given the country’s advanced industrial capabilities, particularly in the automotive, renewable energy, aviation, textiles, pharmaceuticals, phosphate, mining and food industries, in addition to its strong talent base, advanced infrastructure, and global partnerships.

Morocco’s GDP exceeded $134 billion in 2022. The country’s industrial sector provides more than 1 million jobs, through some 121,000 companies. Additionally, there has been an increase in foreign direct investment (FDI) in the manufacturing sector.

Morocco has entered several strategic agreements with other countries, including free trade agreements providing access to more than 100 countries representing 2.3 billion consumers. Ongoing industrial modernization and development plans have enhanced its competitiveness, boosting investor confidence and establishing Morocco as a regional destination for manufacturing and industrial investment.

Industry is a key sector in Morocco and has seen significant development in recent years with a focus on automotive, renewable energy, aviation, textiles, pharmaceuticals, phosphates, mining, and food industries.

Morocco is accelerating the sector’s development, implementing a new industrial policy aimed at increasing its contribution to GDP to 23% by 2030, creating more than 500,000 new job opportunities, and investing billions of dollars in renewable energy projects.